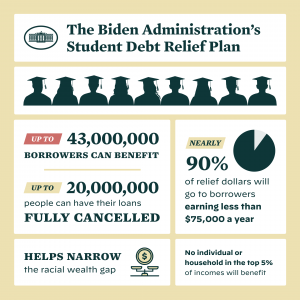

WOULD YOU OR WOULD I GET OUR STUDENT LOANS FORGIVEN

sites.edu.gov

my answer is yes

whats your answer

if there was a new federal tax exemption that you didnt agree with that would save you $20,000 would you take the exemption and save on your taxes

or

would you say no i dont agree with it

most of you plus me would take the exemption

if this student debt relief plan was available when i was finishing all my school and training

you betcha i would have filled out the forms to see if i qualified

here is a link to the rules and q and a on the student debt relief plan

when i finished all my schooling and training i owed around $20,000

it took me over 15 years to pay it off

the amount was higher because of interest

in college i received scholarships and grants and took out school loans

in medical school i took out more loans

i also received a national health service scholarship that paid my tuition and fees and gave me a stipend for 3 years

in return i owed 3 years i had to serve in an underserved area

my loans and interest was deferred though medical school and residency and through my 3 year obligation

when my obligation ended i started the 15 years it took to pay off the loans

i finished in time for my kids to start college

would i have taken advantage of loan forgiveness if it had been available

yep i would have without second thoughts

just like i did tax exemptions i took that were legal but didnt seem fair to me but i took them anyway

they saved me thousands of dollars in taxes

so would you

most if not all of you would

i looked at the list of eligible school debts from the link above

i had several of those that would have made me qualify

also later on my income level would start limiting my loan forgiveness

so take a look at that link above and repeated here and see if you qualify or your family members qualify or friends qualify

if you do

get your application processed as per the link above

if you wait it may be too late as it ends 12-31-22

here is a good review article on the loan relief program

yep or you betcha or yes

i would have applied for this loan forgiveness just like i did for those doesnt seem right tax deductions

also you may qualify for loan forgiveness under the public service loan forgiveness program linked here

the organicgreen doctor

welcome to the organic green doctor blog

i am a family physician who was diagnosed with

early mild cognitive impairment(mci) amnestic type on december 21, 2010

this is a precursor to alzheimers disease

because of this diagnosis i have opted to stop practicing medicine

this blog will be about my journey with this disease

please feel free to follow me along this path

i will continue blogging on organic gardening, green living,

solar power, rainwater collection, and healthy living

i will blog on these plus other things noted to be interesting

Monday, September 26, 2022

would you or would i get our student loans forgiven

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment